Why does Deutsche Bank need Design Thinking at All?

When you think of Deutsche Bank’s description as a “multinational investment bank and financial services company”, you immediately have in mind complex structures, processes and investment strategies. But you wouldn’t suspect that Deutsche Bank also relies heavily on their relationship with their customers. But in retail banking, the bank depends on the trust of its customers. This trust can be gained by proceeding transparently in the development of new products and services. One way to do this is through customer-centricity in the innovation process. Customer-centricity is a term that comes up frequently in the context of design thinking. It describes the precise understanding of customer needs and demands in order to design appropriate products and services. With the increasingly rapid digitalisation, Deutsche Bank was also faced with the need to offer new innovative products and services. It used to be the case that the customer’s problems were passed on to the manager via an employee of the Business Division. The manager then agreed to pass the problem on to the IT Division. Once the IT Division had received the problem, it started to develop without any contact with the end customer. You can imagine how closely the final product fulfilled the customer’s needs if you have ever played “Chinese whispers”.

The Evolution of the Still Ongoing Design Thinking Practice at Deutsche Bank

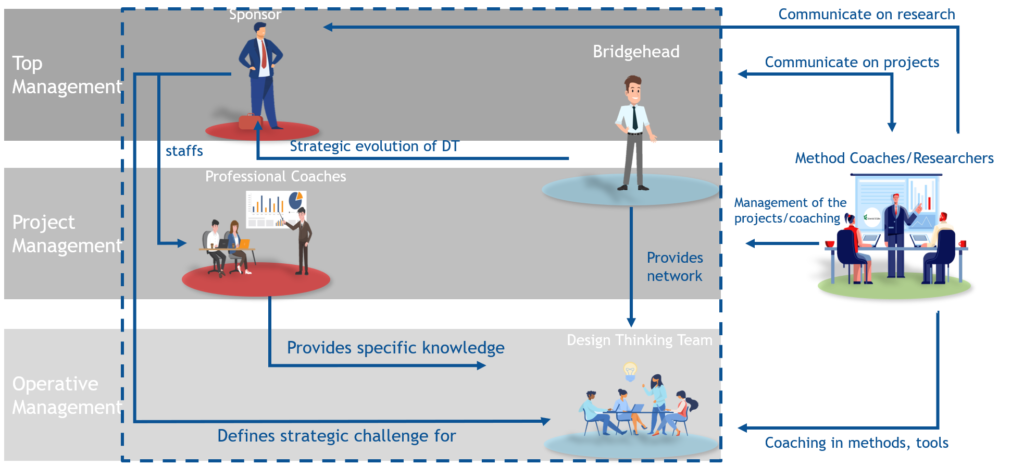

The following evolution spans 6 years of work. This work has divided into three phases, Phase 1: Learning, Phase 2: Adapting and Phase 3: Diffusing. In Phase 1 the journey began. Very quickly it became clear that it was not possible to immediately change the thinking structures and processes in such a large international bank. For this reason, they agreed early on to take small, successive steps. Numerous challenges and restrictions followed. Deutsche Bank was very mindful of using few resources and generally maintaining a lean structure. As a result, no members from the IT division could be recruited for the Design Thinking team, as they were all working on ongoing projects. The Design Thinking initiative, on the other hand, was isolated from all projects. The heads of this initiative then came up with a new plan and, in the spirit of Design Thinking, they recruited people without any bias in the banking sector – namely interns. The interns had nothing to do with the banking sector, they were engineers, designers and physicians. But exactly this was an optimal basis for fully internalising the Design Thinking approach. But the disadvantages were also obvious: how can I embed a completely new concept into an already existing organisation – for that, let’s take a look at the organisational structure below:

| Role | Description |

|---|---|

| DT Team | Application of the DT method to relevant strategic challenges in order to create a final prototype |

| Bridgehead | Responsible for the internal strategic development of DT and for connecting them to the organisation and vice versa through networking |

| Sponsor | Representing top management, defining the challenge and assigning professional coaches to the DT teams. |

| Professional Coaches | Providing specific know-how and expertise to DT teams and attending the teams’ activities (presentations, workshops, etc.) |

| Innovation Community | Not formally assigned to DT projects but showing interest in DT activities via attendance at workshops, communication activities, spreading DT information by word of mouth |

| Method Coaches/Researcher (initially external but later internal) | Responsible for educating Deutsche Bank staff in the DT methodology, communicating method related issues and identifying findings from DT projects and reintegrating the findings in future projects |

The next phase was the adaptation phase, where the focus was on adapting the structural and educational aspects of the approach. Deutsche Bank was aware of the necessity to mix the teams, so they created the new DT teams with one full time employee and additional interns. The IT division was experiencing the results of the DT team first hand and adopted some techniques and approaches as well. For example, they changed the method from defining certain requirements. They also learned that there is not always one solution, but rather a variety of solutions to be explored. Furthermore, it was not obliged to consider ideas as radical innovation, but rather offered space for incremental innovation. This also allowed for better integration into existing work. A great added benefit was the valuing of the diverging phase. In a simplified way, hence the name DT Lite, they adopted basic concepts in the process of developing ideas. With increasing commitment, a stronger and stronger innovation community also developed. This was always supported with enough educational programmes. At some point, after the end of the Design Thinking projects, the members of the DT teams were transferred. For example, when an initiative was handed over to the IT Division, members of the DT team were also transferred in order to spread the gained knowledge.

This diffusion is a big part of the third phase. With this continuous diffusion, DT Methodology became more and more respected. People from the company were eager to learn about it and have it on their CVs. DT gained a lot of value because it was assigned to greater tasks. The assignments were often tasks that had been considered unsolvable in the company for a long time, and therefore even more employees elevated DT as a powerful way to solve difficult tasks.

Lessons Learned

What can be taken away from this story?

First of all, it is essential to recognise that the implementation of Design Thinking in an existing structure needs certain preconditions. A very crucial one is the organisational structure. Only with an organisational structure it can be ensured that the DT members can perform the methods properly. This also includes a certain budget for e.g. prototype development.

The second important point is the providing of important education programmes. For the diffusion of the concept, it is necessary to enthuse the workers for the idea in a configuration that is as accessible to them as possible. For example, they have to give presentations, deliver results, and so on.

The third point is the strategic positioning of DT team members. In order to use and spread the acquired knowledge, DT members must be involved in relevant projects, so that they can also share their knowledge.

The fourth point is definitely for Design Thinking and that is prototyping. Prototyping is an approach that has completely won acceptance at Deutsche Bank because it is so effective. There is hardly any comparable method that collects so much feedback on an idea so quickly. One manager said that the existence of a prototype in his office was enough for stakeholders to discuss about it.

The last point that rises a little above all others is the recommendation to take an evolutionary approach to build Design Thinking. Unlike other methods, Design Thinking is not just a tool, it is a culture. And as with any culture change, there are inherent challenges that need to be overcome. And that costs time, money and people. Some say that the term “innovative company” is an oxymoron in the context of large companies because large companies face a number of barriers to innovation. But the case of Deutsche Bank has proven that it works and can therefore be used as an important lesson for learning CIOs and IT directors.