Poverty in the US – An introduction into savings and income

In todays society a big gap between poverty and wealthy exists. For many people it is a challenge to get through each month with their earned money and especially in the end it can get close to ration food or other needed things. In a report from the Federal Reserve it states “that only 64% of Americans had enough money on hand to cover a $400 emergency” [PA24]. This means that on the opposite side at least 36% of Americans cannot cover such a raver low amount. Another study from LendingClub and PYMNTS discovered “that 60% of adults live paycheck to paycheck” [PA24]. High expenses often lead to “borrowing or selling something” [PA24]. Further statistics reveal that especially people of young age under 35 have a low median amount of savings around $3,240. Other influences are in example the education degree, where a High School diploma ($2,500) more than doubles the median amount of people without a high school diploma ($1,020). Further the median amount of savings strongly depends on the income. Especially people with an income less than $59,900 tend to have a low median amount of savings (up to $4,320). Another important part is the ethnicity one is part of. White people (Median $8.200) tent to suffer less often from low savings than black (Median $1,510) or hispanic ($1,950) people. [PA24]

To tackle this problem the American Family Insurance, an insurance company founded in 1927 that offers varies insurances around auto, home, business and life, initiated a program [IB24]. In cooperation with IDEO, a design company that shapes and validates the probability of projects through a design thinking process, a solution for people in the US that are confronted with poverty challenges has been seek [IA24]. The American Family Insurance started the collaboration with the idea, that people are needing better budgeting tools than the currently available solutions “in order to have a better overview of their expenses” [IM24].

Utilizing the power of Design Thinking

In order to validate the initial project idea IDEO and the American Family Insurance utilized design thinking.

The first step of design thinking is to empathize with the potential client. Looking back at the underlying statistics the main costumer group are people with a rather low income caused by a low education degree and a minority background. In order to fully understand their needs, the development team needed to put themselves in the position of their potential customers. The American Family Insurance and IDEO realized the empathy in example by visiting a single mother of four children in Tennessee. The design team thereby sat together with her in her kitchen while she explained to them „how her lifestyle was built around her extremely constrained budget“ [IM24]. For her it was not possible to afford childcare for her children so that her oldest child had to watch the younger children. Further the snacks were partitioned, there was a timer on the TV and the family followed a strict chore chart hanging on the fridge. This example perfectly describes how the design team puts themself into the position of their potential customers to truly discover the challenges and needs. [IM24]

Following the design thinking process after empathizing with the situation of the potential customers the needs needed to be defined. Looking back at the initial project idea it became obvious that the proposed solution to create better budgeting tools to gain a better overview of the financial situation does not fit to the actual customer need. The mother managed „her budget meticulously“ [IM24] and instead of managing it even better she needed a way to extent her income in order to increase her financial cushion. An important factor to take into account was also that the people that needed extra income often work in a fulltime job. The team therefor needed to take care about the stress work on top of a fulltime job could cause. [IM24]

The idea resulting from empathizing and defining the situation of many low-income people in the US was Moonrise. The goal of Moonrise was „to help families living on the edge bridge the gap between the size of their paychecks and the size of their dreams“ [IM24]. Moonrise should be a platform to hire employees that „need extra money“ [IM24] in exchange for on demand work. Workers should be matched with „employers who need to fill extra shifts“ [IM24].

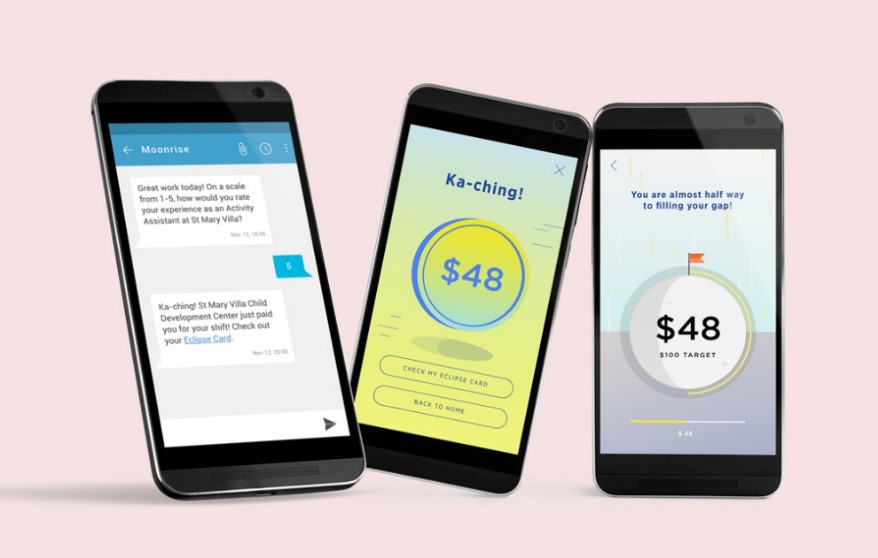

In order to test the proposed idea a prototype was needed. Moonrise developed a message based platform where workers can sign up for shifts with partner organization through a simple chat. „As soon as their shifts are done“ [IM24] the worker gets paid by the employer. On the other hand employers that signed up to Moonrise „can list open shifts on the platform“ [IM24].

After an initial prototype has been created the idea needed to be tested in a real time scenario. Therefor IDEO and the American Family Insurance built a team of 11 workers, six employers and a team to organize and enhance the test program. In a first test in Wisconsin the 11 workers completed in one week 28 work shifts by „earning an average of $121 each“ [IM24].

Results and what we learned from Moonrise

Due to the successful test of the developed prototype the American Family Insurance founded Moonrise as a startup and launched it to the public in Chicago in 2018. A first partnership has been closed with Enterprise Rent-A-Car as a first employer in Chicago. Since 2018 Moonrise actively matches workers in Chicago with open shifts. Until 2020 over “7000 people applied to become Moonrisers” [IM24] with finishing more than 7000 shifts earning combined over $500.000. Due to the success of the program Moonrise planed expanding into three additional states in 2019. [IM24]

Unfortunately, the current state of Moonrise is fairly unknown. It is hard to find additional information after 2019 about Moonrise and their website is not reachable anymore. Additionally, Moonrise lacks social media appearance. It is likely that the startup failed due to the covid crises starting in 2020 and never recovered from it. Still the problem Moonrise tried to tackle remains the same and potentially increases due to ongoing crises.

Although the current state of Moonrise is kind of unknown the use of Design Thinking especially in the beginning of the project has been a success story. The initial idea of creating a better budget management app did not come close to the real costumer needs which has been discovered through utilizing Design Thinking and turned into an at least in the beginning successful startup. Moonrise closely addressed the needs of people facing poverty due to low income and allowed them to earn extra income that could potentially make a high budget difference. The potential failure of the company is likely lead back to the outbreak of covid and the following challenges especially in hands on local work that could not be fulfilled in remote jobs. Another issue might be the text-based platform that potentially came with a high demand of management which likely made the project itself not profitable.

A few learnings result from the described use case of Design Thinking. Apparently Design Thinking should be used to clarify the customer needs. The importance of this is especially relevant in the beginning of a project where the idea itself can be easily shaped. Another aspect to consider is that although Design Thinking has been used in a project its outcome is still influenced by environmental factors and is shaped by the implementation. A bad implementation or hard environmental conditions still can lead to a project failure although the likelihood of turning the project into a successful one is strongly increased by Design Thinking.

References for further look up

[IA24] IDEO, „A global design company“, https://www.ideo.com/about, as of 03.04.2024.

[IB24] Insurance Business, „American Family Insurance: Everything you need to know“ https://www.insurancebusinessmag.com/us/companies/american-family-insurance/117129/, as of 03.04.2024.

[IM24] IDEO, „A new Employment Venture to Increase Customer Engagement and Financial Security“, https://www.ideo.com/works/a-new-employment-venture-to-increase-customer-engagement-and-financial-security, as of 03.04.2024.

[PA24] Payne K., „Average American Savings Account Balance“, https://time.com/personal-finance/article/average-american-savings-account-balance/, as of 02.04.2024.